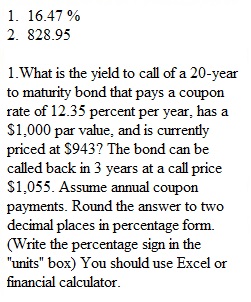

Q 1.What is the yield to call of a 20-year to maturity bond that pays a coupon rate of 12.35 percent per year, has a $1,000 par value, and is currently priced at $943? The bond can be called back in 3 years at a call price $1,055. Assume annual coupon payments. Round the answer to two decimal places in percentage form. (Write the percentage sign in the "units" box) You should use Excel or financial calculator. 2.Bright Sun, Inc. sold an issue of 30-year $1,000 par value bonds to the public. The bonds had a 7.42 percent coupon rate and paid interest annually. It is now 12 years later. The current market rate of interest on the Bright Sun bonds is 9.43 percent. What is the current market price (intrinsic value) of the bonds? Round the answer to two decimal places. 3.23 years ago, Delicious Mills, Inc. issued 30-year to maturity bonds that had a 7.86 percent annual coupon rate, paid semiannually. The bonds had a $1,000 face value. Since then, interest rates in general have changed and the yield to maturity on the Delicious Mills bonds is now 12.37 percent. Given this information, what is the price today for a Delicious Mills bond? Round the answer to two decimal places. 4.Dan is considering the purchase of Super Technology, Inc. bonds that were issued 7 years ago. When the bonds were originally sold they had a 22-year maturity and a 8.25 percent coupon interest rate, paid annually. The bond is currently selling for $723. Par value of the bond is $1,000.What is the yield to maturity on the bonds if you purchased the bond today? Round the answers to two decimal places in percentage form. (Write the percentage sign in the "units" box). Answer:

View Related Questions